There is a golden chart in every aspect of life, be it personal or professional. These rules help you navigate difficulties and hit the goal with minimal setbacks. Accounting is about assisting businesses and individuals in understanding, analyzing, and monitoring their financial transactions and status and making informed decisions based on data-driven insights. However, there is more to accounting than just bookkeeping; the business language provides accurate data on the income, expenses, financial status, assets, liabilities, and performance of a company. Providing an organized and systematic framework to record finances, ensure compliance with legal and regulatory requirements, and report accurate financial results of a firm forms the underlying principles of accounting.

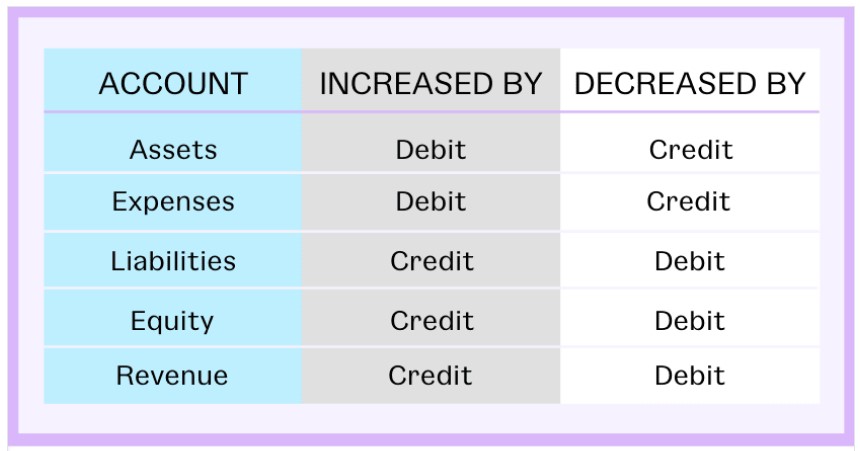

Before understanding the 3 golden rules of accounting, businesses must make an effort to understand debits and credits. Every transaction has two entries: credits and debits, the two factors that form the backbone of financial transactions. Therefore, it is important to understand the appropriate accounts to be credited and debited.

The golden rules of accounting form the basis for providing accurate and reliable financial reports and enable businesses to make well-informed decisions. Engaging in tax accounting services ensures that you keep your accounts updated with the latest transactions and provides a timely representation of your firm’s financial standing. The three golden rules of accounting, with examples, are briefed below:

- Rule 1: Debiting receivers, crediting givers: This rule applies to managing personal accounts and general ledger accounts related to individuals or organizations. The fundamental idea is to record a debit entry in the account when receiving something and a credit entry when giving something. For example, if you buy goods worth $1000 from a firm QWERTY, you should debit your purchase amount in the accounting records while the company, being the giver, is credited. Your purchase account, being the receiver, is debited.

Example 1

Let’s consider the scenario where you make a $1,000 purchase from Company ABC. In your financial records, you would record this transaction with the following accounting entries:

- Debit the Purchase account for $1,000, representing the increase in expenses:

- Debit: Purchase Account $1,000

- Credit Company ABC for $1,000, indicating the decrease in your liabilities (as you owe less to Company ABC):

- Credit: Company ABC $1,000

By doing so, you properly record the transaction and account for the purchase of goods from Company ABC in your books. The debit entry reflects the increase in expenses, and the credit entry reduces the amount you owe to Company ABC, showing the flow of goods from the giver (Company ABC) to the receiver (your Purchase account).

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Purchase | 1,000 | |

| Accounts Payable | 1,000 |

Example 2

Suppose you made a $500 cash payment to Company ABC for office supplies. To properly record this transaction, you would need to do the following accounting entries:

- Debit Company ABC for $500, reflecting the decrease in assets (as you paid them):

- Debit: Company ABC $500

- Credit your Cash account for $500, indicating the reduction in cash on hand:

- Credit: Cash Account $500

By doing so, you accurately document the cash payment for office supplies, debiting the receiver (Company ABC) and crediting your Cash account as the giver. This ensures the proper accounting of the transaction in your books.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Supplies | 500 | |

| Cash | 500 |

- Rule 2: Debiting inflows, crediting outflows: The rule of ‘debit what comes in, credit what goes out’ applies to real accounts that pertain to tangible assets like land, furniture, buildings, etc. Real accounts typically have a default debit balance, and any incoming transactions are debited to increase the current account balance. Similarly, the account balance must be credited when a tangible asset exits the company. For instance, if you buy furniture for $5200 in cash, record the transaction by debiting your furniture account (representing what is received) and crediting your Cash account (representing what is paid out).

Example

Imagine you bought tiles for $2,500 in cash. To record this transaction, you should:

- Debit your Tiles account (representing the increase in assets, as tiles are added to your inventory):

- Debit: Tiles Account $2,500

- Credit your Cash account (indicating the decrease in cash due to the payment):

- Credit: Cash Account $2,500

By following these entries, you accurately document the purchase of tiles, debiting the Tiles account for what comes in and crediting the Cash account for what goes out. This maintains proper accounting in your financial records.

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | Tiles | 2,500 | |

| Cash | 2,500 |

- Rule 3: Debiting costs and losses, crediting revenues and profits: It applies to temporary or nominal accounts closed at the end of every accounting period. Such accounts include expenses, losses, profits, and revenues. According to this rule, a company’s capital is considered a liability and maintains a credit balance. The capital increases when gains and income are credited and decreases when losses and expenses are debited. For example, if you buy $8,000 worth of goods from a company PQR, you must make a debit entry for the purchase expense and a credit entry for the corresponding income.

Example: Revenue or Earnings

Let’s consider a scenario where you sell $1,700 worth of goods to Company XYZ. To properly record this transaction, you should:

By following these entries, you accurately record the revenue generated from the sale of goods, debiting the Cash account for the amount received and crediting the Sales Revenue account for the income or earnings. This ensures accurate accounting and tracking of your business’s financial performance.

| Date | Account | Debit | Credit |

| XX/XX/XXXX | Cash | 1,700 | |

| Sales Revenue | 1,700 |

The golden rules of accounting govern the systematic recording of financial transactions and simplify the complexities of bookkeeping into understandable and practical concepts. Mastering them is essential for anyone navigating the intricate accounting world successfully. AD Audit, a leading audit, consulting, and tax firm in Abu dhabi, offers highly customized services using technology to enhance audits’ efficiency, effectiveness, and accuracy while maintaining its high-quality standards. The company fully embraces the role of technology in accounting and leverages AI, machine learning, and automation to monitor potential fraud, mitigate risks, and streamline processes, leading to faster identification of aberrations and automated handling of manual tasks.